FlashNews:

Poco M5 Price: A Comprehensive Look at Its Pricing and Value

Nokia G10 Price In India: Check Price and Specifications

Walmart Vienna Wv (West Virginia) Supercenter

Iphone 15 Pro Max 512gb Price In India

The Benefits of Using Proposal Management Software for Streamlining the Proposal Process

Buy Best Smartwatch Under 5000

Walmart Duluth Mn – Supercenter in Hermantown | Store #1757

The Benefits of Using Pre-Roll Tubes for Cannabis Packaging

Computer Classes Near Me – Surat

Walmart Nintendo Wrist Strap: The Essential Gaming Accessory

Leveraging AI Content Tools for Your Social Media Strategy

Kitchen Store Near Me – Houston Supercenter

Overview of Walmart in Winchester, VA

Walmart Hanover Pa: Patio & Garden, Electronics and More

Pyra And Mythra Amiibo – Nintendo

6 Essential Technologies Every Company Should Adopt in Their Transport Department

How Omnichannel Contact Center Drive Efficiency and Innovation in Tech Businesses

Https //Www.Instagram.Com/Accounts/Login/ Next=/Accounts/Remove/Request/Permanent/. Po

Walmart Tiffin Ohio Stores Supercenter Address

Business

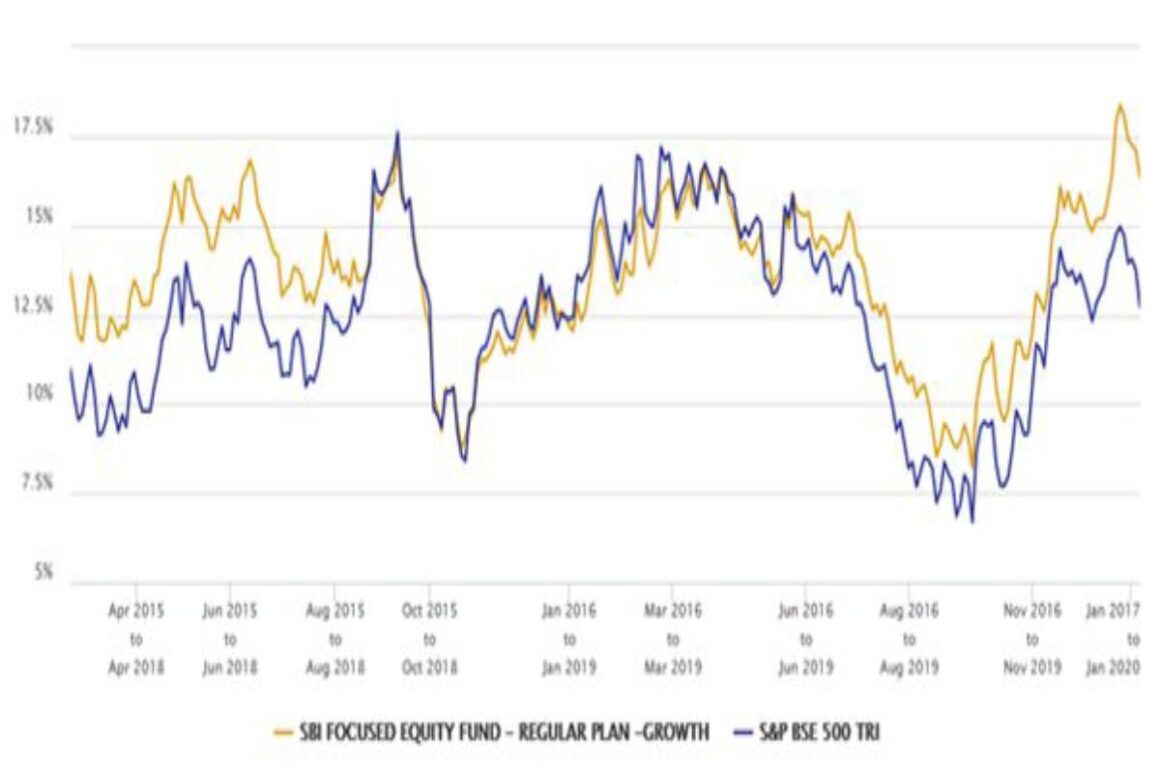

MUTF_IN: SBI_EQUI_HYBR_VUWAZQ Fund Overview